As someone who recently purchased Bitcoin and two other crypto currencies using three different methods, I thought I’d share how to buy Bitcoin because I know there’s precious little information out there:

Coinbase:

The easiest way I found without leaving your computer is to sign into Coinbase.com and add your bank account. They’ll do 2 small deposits, you need to wait around 2 days for them to show up, then you verify your account by telling them what the deposits were. Once that’s done you can make your first Bitcoin buy using coinbase.

NOTE that when buying with Coinbase, you only get to make one purchase until it clears which takes around 7 days right now. So buy whatever the maximum bitcoin is that you want to purchase on Coinbase in the next week. The good news is that the bitcoin price will lock in at the time of purchase so even though you’ll only be able to spend your bitcoin after the transaction is approved 7 days later, you still benefit from locking in the price at the time of purchase. For me that meant several hundred dollars in gains because the price was rising steeply when I bought and it continued to rise over the next week.

The benefit of Coinbase is that you don’t need to leave your computer to do it and you don’t need to meet strangers in a dark alley (see below). The down side is that it takes 7 days before you can spend your bitcoin and you need to give them your bank account details.

In Person:

LocalBitcoins.com is a reputable site which is popular with the Reddit community and they have ads for people local to you who are selling Bitcoin. The sites popularity has grown enormously in the last few months and every town world-wide (including South Africa) that I’ve checked has bitcoin for sale.

LocalBitcoins has a reputation system similar to eBay that lets you find someone who has a good reputation for not scamming folks. I found someone in Denver, Colorado yesterday and within about 30 minutes of contacting them via the site they phoned my cellphone. We arranged to meet in a parking lot outside a well known computer store. The guy was a typical twenty-something computer geek type – really nice guy actually. I was happy to give my first name but he seemed to want to go by his online handle. I handed him a rather large stack of cash and then we spent a few minutes figuring out what the best way was to send the Bitcoin. I ended up using the Bitcoin wallet for Android, he scanned my QR code, sent me the coins at the current localbitcoins.com exchange rate (which was quite good) and within 10 seconds my phone went KACHING and I had my Bitcoin. We said our goodbyes and that was it. Except…..

PRO TIP: If you’re buying Bitcoin from someone in person, make sure they include a small transaction fee with the Bitcoin when they send you the coins. If they don’t, the coins will show up in your wallet but it may take several days until you can actually spend them. The guy I was buying from had a wallet that added zero transaction fee and I had to wait just under 5 hours until the transaction was finally completed by the network and the coins became spendable. I did a few tests later and added everything from 10 US cents to $9 as a transaction fee and it radically improved the processing time. The $9 transaction fee took 30 minutes to complete and when adding a few cents it takes about an hour. Many wallets don’t give you the option of adding a transaction fee. The Bitcoin-QT client does give you that option and I understand that the “Mycelium wallet” for android lets you modify the transaction fee but I haven’t verified this. The miners who process your transaction get the fee and they prioritize transactions with fees associated with them first.

The benefits of buying in person are that you get your bitcoin immediately and you usually get a better price that you do if you’re buying at an exchange or a service like Coinbase. The down-side is obviously that you might get mugged or scammed. But with a reputation system like LocalBitcoins and meeting in a crowded place, there are ways to minimize that risk.

Buying on exchanges:

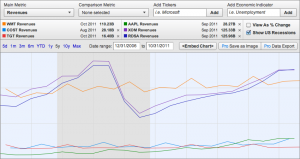

After buying bitcoin I wanted to buy some Litecoin and found BTC-e exchange which offers trading in several other Crypto currencies. Note that BTC-e is based in Bulgaria and no one knows who the owner is so it’s highly risky. You’ll notice that all crypto currencies are cheaper on this site and it’s because of the risk premium. So I send them some Bitcoin as a deposit and started trading – bought some Litecoin which has yielded a nice profit along with some Feathercoin which is still extremely cheap and new and has also behaved quite nicely since the purchase.

I haven’t used Mtgox, but I understand that it only offers Bitcoin trading at this point which seems a little pointless because that doesn’t really make it an exchange – more of a place to buy Bitcoin like Coinbase.

Conclusion and my recommendation:

If you’re going to buy Bitcoin in the USA at this point, and if I buy again, I’ll definitely buy in person. It’s very fast, fun and with the reputation management that LocalBitcoins offers it seems fairly safe. If you have patience, Coinbase seems like a good option but in a fast moving market it moves a little too slowly for my liking.

Happy crypto currency trading!!!

Update:

Since I posted this 6 days ago, I’m still trading occasionally on BTC-e, but only alternative crypto currencies. I do all my Bitcoin buying on Coinbase. Today there were claims on Reddit that some folks couldn’t get their money out of BTC-e. Turns out BTC-e’s email servers were down for a while, so anyone who had email verification for withdrawals couldn’t withdraw their money. Sounds like an honest bug that hit BTC-e. I’m still quite happy there although I never leave a positive balance on the system. I’ll deposit, trade and then get out. Also note that they charge 0.1 Litecoins (About $4 today) for a litecoin withdrawal and .001 Bitcoins (About $1.20 today) for a Bitcoin withdrawal. The Litecoin folks are up in arms about this.

Since I wrote this I’ve made another trade on Coinbase on Dec 1st and am happy, although the delay to get coins is 6 days, even for your second trade. [Rather than the 4 days I wrote in the comments below]

I’ll also note that since the writing of this article I have been trading more alternative crypto currencies including Litecoin, PrimeCoin and Feathercoin. There is a lot of “pump and dump” activity around these currencies. They’re being treated like penny stocks. A cartel of people will get together, spend a few hours either boosting or insulting a particular currency to try and generate buy or sell activity, take the opposite action, and then send the opposite message. They use forums, live chat, twitter, blogging and so on. Litecoin is getting too large in market capitalization to do this (passed $1 billion compared to Bitcoin’s $13 billion and the third place Peercoin’s $136 million market cap). But smaller crypto currency perception is being manipulated by groups of folks, so beware. I still think it’s fine to trade in these currencies, but wait for a drop to buy and ignore the intra-day noise you see on forums and social media.