Google Groups archive of the STS mailing list isn’t working reliably, so I’m archiving a few emails I’ve sent to the STS list here. One day when I have too much time I’ll create a reliable threaded archive of the whole list. I sent this as a reply to a “getting started” advice request from a Seattle entrepreneur:

Alfredo,

I’m sure you’re going to get a lot of advice from the good folks on this list. I’m going to give you my three cents:

Firstly, welcome to the very difficult but very rewarding world of creating a business out of nothing. It’s people like you who are the foundation of this country’s economy and prosperity. If you succeed you will be providing job security for hundreds, possibly thousands of people and you will have created a useful product or service.

You are joining the entrepreneurial ranks at an interesting time. Things are changing. Two years ago, if you hired a few developers on elance, created some useful software in an interesting sector and got a few hundred thousand people using it it was quite likely that you could sell your company to a bigger company without actually having to earn any money.

Today it’s a much harder environment. It’s more difficult to find investors and you can’t “build to flip” (build a business to sell it) as easily. But things aren’t as bad as they might sound.

People with great ideas who live in places outside the normal technology centers have been creating businesses every year that earn good old fashioned cash. People who are in the traditional technology centers like Silicon Valley are now catching on to the idea of having their businesses earn cash too.

That’s a good thing because it makes things much simpler. It’s a lot like running a lemonade stand: You create something that is worth more to your customers than the price you charge them for it. Perhaps you create a cup of lemonade that is worth a whole lot to a customer because it tastes so good and they’re darn thirsty, so they pay you 25c for it.

Rule 1: Create a business that brings in cash.

People think that running a business is complicated and that you need to do all kinds of preparation before you can even start actually doing the things that are going to make you money. They’ll tell you that you should incorporate, that you should get trademarked, that you should get office space etc..etc. Usually these are the same people that will make money out of you every time you do one of these things. The only thing you need to figure out is how to bring cash money through the door to pay yourself and grow your business.

Rule 2: If you are doing something that isn’t helping your business bring in cash, see rule 1.

So don’t worry about incorporating for now. Don’t worry about funding. Don’t worry about legal fees. Just start doing the thing that is going to make you cash money. Work fast because every day you work full-time on this business is a day you’re not earning a full-time salary. Once you have a company that is earning money you can worry about getting the legal protection that incorporating gives you, getting office space for your new employees and about protecting your now valuable trademark.

Entrepreneurs don’t often realize how hard it is to create a profitable company because they look around and see everyone creating or running a startup. But most startups, especially in technology centers like Seattle are not profitable. They are burning through investor cash or founder cash and will eventually go away and be replaced by other startups that are burning through investor cash and confusing entrepreneurs. That wouldn’t be a problem, except that every time one of them goes away, it leaves an entrepreneur in its wake with 4 wasted years and usually poorer than if he or she was earning a regular salary.

To get an idea of how hard it is to create a profitable company, think about creating a company that earns you $200,000 per year. I don’t mean go out and get a consulting job and work 14 hour days. I mean create a real business that earns you slightly more than you would earn at a regular job. Sounds a little harder now doesn’t it?

The good news is that it’s almost as hard to create a small profitable business as it is to create a big profitable business. In fact if you create a small profitable business that can scale, then you’ve actually solved much of the problem of creating a big profitable business. And once you have a small profitable business that works, it’s easy to find investors to help you grow it. In fact you might not even need investors to grow your small profitable company and you can keep 100% of your company for yourself.

So my advice to you so that instead of getting investors to buy you a few years to test one idea that is very likely not going to work, why not start off small and take an approach that lets you try out many ideas until you find one that works.

Rule 3: Your first goal in creating your new cash generating business is to pay your own salary.

If you can pay yourself and still have money left for the business then you’ve solved a very very hard problem and they only thing you need to do is to scale that business. But it’s very important that you don’t cheat and make the business completely reliant on you. So you can’t get a consulting job where you’re selling yourself. You must create a business with multiple customers in which an employee can replace you at any time without any disruption to the business.

Rule 4: Create a business that can scale – with multiple customers and in which you can be replaced.

As I mentioned before, every day you work full-time on this business is a day you’re not going to be earning a full-time wage. So you need to work fast. You need to get from zero to the day that you can pay yourself as quickly as possible.

Most business ideas fail. Many of them seem like great ideas before they become real, but once they’re created as businesses in the real world they turn out to be hopless. The way you solve this problem is you try out as many ideas as you can as quickly and as cheaply as possible. Take $4,000 that you were going to spend on legal fees and use it to get cheap offshore developers to create 8 websites that you can test. If it costs too much to create fully fledged products then create pretend products that you can use to gauge customer interest. As quickly as you can, figure out which onces the customers love and, more importantly, which one they will pay for. And then do that as fast as you can.

Rule 5: Rapidly try out ideas until you find one that is highly likely to work.

If at any time you find out that your new business is not going to work out then stop wasting your time and money on it and move on to the next idea as fast as possible.

Rule 6: Fail fast because wasting time on a business that will fail wastes money and opportunity.

Once you find a business that you know will bring in cash, focus all your energy on getting that business as fast as possible from that starting point to the day it can pay your salary and earn enough money to hire your first employee.

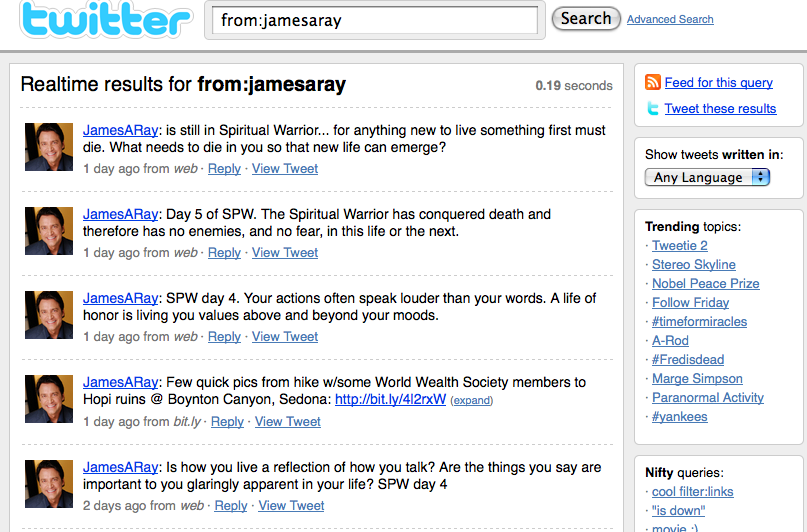

Remember that companies like Twitter may look glamarous and exciting, but they aren’t yet profitable and there are plenty of people making millions in profit picking up garbage and fixing plumbing – even in the online world. [Why does GoDaddy come to mind]

The last piece of advice I have for you is to do something you love. You’re going to be spending many late nights and early mornings working very hard and that love for your work is what will keep you coming back.

Mark Maunder