What if we lived in a world where all transactions were person to person and cost almost nothing.

What if we lived in a world where the money you save gradually becomes worth more, not through interest, but simply because as time passes you can buy more stuff with the same amount of money.

What if debt becomes a very bad idea because, if you owe 10 units of currency today and the currency is slowly becoming worth more, then you would gradually owe more money. So no one would want to go into debt.

What if debt becomes a very bad idea because saving becomes a very good idea, because whatever money you have becomes worth more as time passes. It becomes worth more, not because it’s being exploited by a bank, but because more people want the same amount of money.

This is the world we’re headed into because that is how Bitcoin works. It’s a parallel universe for banks and one that leaves them at a massive disadvantage.

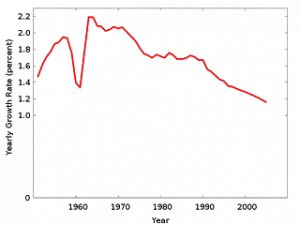

Bitcoin is not a central bank currency where money supply can be regulated by policy, policy that can be lobbied and manipulated by the captains of industry. Bitcoin’s money supply is governed by an algorithm, and that algorithm ensures that Bitcoin will always suffer from deflation. That means the rate at which Bitcoin money is created will slow down and eventually stop. So as long as economic activity (which dictates money demand) is slowly increasing, the currency will slowly become worth more.

Traditionally, deflation, where money becomes worth more and prices of goods and services fall, has been the economists worst nightmare. That is because when you have deflation, wages fall. Most consumers carry some sort of debt. If you owe $100,000 on your house and your salary drops from $50,000 per year to $30,000 per year, you’re in deep trouble. You start spending less, economic activity decreases and this fuels further deflation. An economy can end up in a deflationary spiral this way.

In the Bitcoin economy, deflation is built into the currency. That means it’s a very bad idea to borrow money denominated in Bitcoin because you’ll end up owing more and more as time passes and never be able to pay it back. But on the plus side, if you don’t go into debt and you decide to save, any money that you hold will gradually become worth more.

This is a nightmare for banks because they want you to borrow money so that you’ll pay interest on your borrowings and they’ll keep the spread between the interest that you’re paying and the interest that they paid to borrow the money they lent to you.

It’s a further nightmare because banks want you to open a savings account and deposit money with them so that you can earn interest on your money so that you can keep pace with inflation. If you don’t deposit money with a bank in an inflationary environment, your money will become worth less. But if you do deposit money with a bank, they will invest it on your behalf, they will earn interest, and they’ll give you a lower interest rate and keep the spread. So if you’re not putting money in a savings account because your money becomes worth more automatically through deflation, banks lose.

So to summarize, you’re not borrowing and you’re not putting your money in a savings account or investment account to keep pace with inflation, so banks have lost revenue from lending and from deposits which let them borrow short and lend long – one of their staple business models.

So where does that leave banks? Well, they could just spend their time facilitating transactions like Visa, Mastercard, The SWIFT network, Western Union Money Transfer and so on. But we’ve already said that with Bitcoin transactions are person to person and cost very little. Banks don’t even get that revenue.

And that is why banks are working very very hard behind the scenes to try and kill Bitcoin before it kills them. Here are some examples:

The banks that are most afraid are banks in developing countries like South Africa, where transaction fees are far higher than first world countries. Fees are higher because depositors tend to be less wealthy and keep much lower balances, so to make up for the fact that there’s less money for banks to invest, they gouge their customers with high transaction fees. Developing countries also tend to have large migrant populations who send money home with services like “Instant Money” which allows for SMS’ing a code to someone who can go to a local supermarket and receive money associated with that code. The transaction fees for services like that are high and if Bitcoin becomes a more cost efficient replacement for both money storage and money transmission, banks in developing countries will lose out on a very lucrative business.

The war on Bitcoin has barely begun. The amount of ammunition that traditional banks have to fight this war is vast, because the ammunition is your money.

The early Internet was more free than the Internet today. Crypto currencies may be the most free they will ever be right now.