Another financial journalist has republished first year econ theory to add their 2c to the Bitcoinosphere and make their press deadline. To summarize: Mr Coy wants you to understand what deflation is, that it’s a nightmare in an economy where debt exists, and that it slows economic growth to a crawl because everyone holds currency as it gains value.

I’ve taken an interest in Bitcoin not because I think it is a “new currency” or can “replace the dollar” or become the new “reserve currency” – all phrases you’ve seen bandied about in popular media. Instead I’m deeply interested and hope it succeeds because I think it may change the nature of currency itself along with the nature of humans.

Bitcoin challenges the notions that most financiers and business people in western economies cherish and take for granted. For example, the ideas that:

Continued economic growth, meaning a continued increase in economic activity, is imperative.

and

Most consumers and businesses are in debt and that is a healthy way to be.

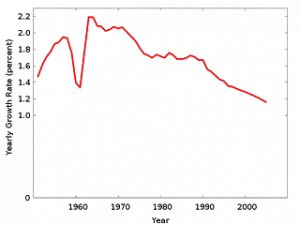

Lets take the first item. Continued economic growth is imperative. What if you’re Germany, Russia or Japan with negative population growth? [Source: U.N.]

Presumably the planet can’t support an infinite number of people. So all countries will naturally progress towards negative population growth or a stable population. It’s inevitable.

Since we all have a finite amount of energy to spend purchasing goods and services, the amount of economic activity will also plateau at some point.

So what if a new currency creates an incentive for the inevitable?

I’d also like to challenge the value system that dictates that more consumption is always good and less consumption is always bad. This has a significant environmental impact, one that is seldom mentioned. For example, the environmental benefit in holding off on buying that so called environmentally friendly new Prius in favor of driving your old car until it falls apart is huge.

The idea that “buying more things” is good for the environment is absurd. In fact buying less things and using your old things longer before you dump them is a much more environmentally friendly approach.

So with zero population growth and the inability of our planet to support consumerism, the idea that “economic growth” is good and imperative won’t be around in a few years.

What means of value exchange might a World with decreasing economic activity demand? Perhaps since you’re going to be holding on to your currency anyway in the face of decreasing economic activity, holding onto a currency that becomes worth more over time is a good thing.

Debt is seen as a good thing. It’s something that has become as embedded in our values as the idea that more economic activity is important and good. But philosophers since biblical times have warned of the dangers of usury and debt. Most western countries have laws against usury and yet still allow organizations that lend to sell usurious debt. If you don’t pay your visa card, the interest rate jumps to over 29% per year. But without inflation, no one will borrow. No one will pay Visa shareholders their fair share of wages.

Two millennia ago the author of Proverbs 22:7 [also appears in the Jewish book of Mishle] said: “The rich rules over the poor, and the borrower is the slave of the lender.”. As consumers we’re encouraged to go into debt as we’re encouraged to buy hamburgers or increase economic activity.

There was a time not long ago when:

- Wise people saved their money.

- Debt was seen as something as bad as gambling.

- Reusing products was encouraged.

In a future world with low levels of debt and high levels of saving, where lack of growth in economic activity is not seen as a bad thing – perhaps a deflationary virtual currency that rewards savers, punishes debtors and encourages lower economic activity in favor of the environment is a good thing. Especially if it insulates us from the greed and corruption of those who influence monetary policy and money supply.

That is why I’m deeply interested in Bitcoin. Because it is and does all of the above. That is why I’m frustrated by Bloomberg, the Financial Times and many other traditional financial publications: Because they see Bitcoin through the lens of traditional undergraduate economic theory which simply reinforces the values we’ve come to take for granted. It doesn’t teach how to conduct an economic revolution and what the outcome might look like.